Mandate explained

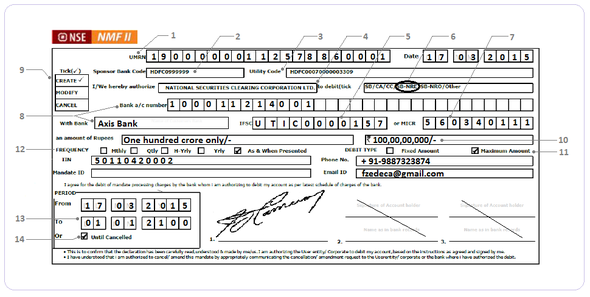

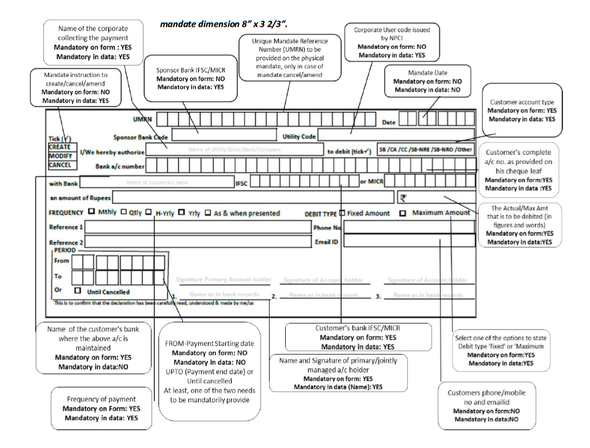

1. UMRN Utility Reference Number provided by the Clearing house (4)

2. Bank where the Clearing house (4) has their account

3. Utility code issued by RBI to the Clearing house (4). Only RBI can allot Utility codes. Only highly secure and trusted organisations are issued utility codes.

4. Clearing house / Mutual Fund / Broker / Depository - all subject to RBI approval and scrutiny

5. 6. 7. 8. Details pertaining to clients (your) bank account from which money is to be drawn. All the money drawn can be routed only into your Mutual fund / Stocks via the clearing house. The system ensures that it cannot be routed elsewhere. Similarly when you sell a fund / stock the money is re-routed back vis the same clearing house into your / the same account.

9. Option to Create / Modify / Cancel the mandate. To cancel, see (14).

10. 11. 12. 13. As and when a Mutual fund / Stock is purchased a bill for the purchase is raised and presented to your/the bank via the clearing house. The is amount is then drawn from your/the account, as and when such bills are presented, subject to a maximum of 100cr, upto 1 Jan 2100. In effect, all future transactions upto 100cr and the year 2100 are paperless. This is exactly the same way a PIS / PINS account operate and the same paperless feature is being brought to Mutual funds. Question: Can someone take out 1, 2 or 100 crore from my account? No, that is immpossible. Money can only go to fund your own Mutual Funds, nothing else.

14. To cancel the mandate anytime, just send us an email instruction.

Deca NRI Services

Deca NRI Services