Income Tax Returns for NRI (ITR for NRI) & How to claim TDS refund

Helpdesk | +91-8197888400 | fzedeca@gmail.com | or leave message here below

Client Reviews

Excellent work from Deca team, as always.

I will always recommend this group for any of the important services like Tax filing, Investments and Government document processing.

Thank you!!

I hired Deca for refund of my NRE TSD. A very professional work particularly assigned officer Jayshree was amazing. Accurate and prompt preparation and submission

, good follow-up and communication

Jayashree was fabulous in her service to us. Very responsive and always answered my queries although I am overseas. Fantastic place to do all your accounting and

tax filing work. 💪🏿😎 …

Highly Satisfactory with the ITR filing Service offered by the respective Team of Deca. Myself, e-filing ITRs through the respective Team of Deca for the last

couple of years. Their Service is timely and Prompt. Mrs. Jayshree Ma'am who had dealt my case, since last couple of years is highly intelligent and kind enough to assist me with utmost patience.

Ma'am had guided me very effectively and advised me and made my filing Processes easier. I'd been issued with the respective acknowledgements for the received supporting documents and the

Processing Fee, on a timely manner and very swift in responses, as well. Highly appreciated the hardwork of the entire Team of Deca. Wishing them all success.

My sincere and humble Prayers to the Almighty to Bless the Team Deca for their future prospects and endeavours.

😊🙏

It has been great experience in interacting with Deca. Thanks for your valuable insights and providing me timely guidance, support to take decision on my

investment. Most appreciated is prompt responses and solving the all queries on time. I highly recommend deca for their quality services and professional staff.

Regards

Nimesh Patel

Suresh BabuI am using DECA service (ITR filing) for many years. I get quality service at very competent rates.

Good work, keep going.

Very professional service and very supportive team. The response from them on all our queries is fast and complete. Will definitely refer them to my friends as

well

Excellent services from Ms Jayshree Deca

I ama NRI and have been using their service for past few years. Excellent service with quick response to any enquiry. I would strongly recommend them

Super efficient. Great staff and always communication done professionally. 3 years I got refund and it was very smooth procedure from NRO to NRE

Good Service.

Very professional service by a dedicated and service oriented team. Thanks to the entire team for their support in the filing of the ITRs.

NRI Tax Services

We provide NRI Tax filing services employing CA's, NRI Tax consultants, Tax Notice / Litigation services, NRI residency / domicile services etc. with an in house legal department. We have a dedicated international ITR helpline +91-8197888400 for those searching for "ITR consultant near me"

Our services:

- NRI Property Tax payments

- NRI TDS payment on property sale & rent

- TDS compliances

- TDS certificate

- NRI TDS Payments

- Capital gain tax

- NRI Power of Attorney POA's

- NRE and NRO account TDS refunds, Lower Tax deduction certificate for NRI

- Handling of notice or summons under Income tax act and Trust act

- Conversion of NRO funds to NRE via RBI scheme

- PAN updation / TAN number / Aadhaar / Aaykar vibhag

- CA services and fees slab for filing ITR

- Help with Form 16A, Form 27Q

- Process Income tax department India

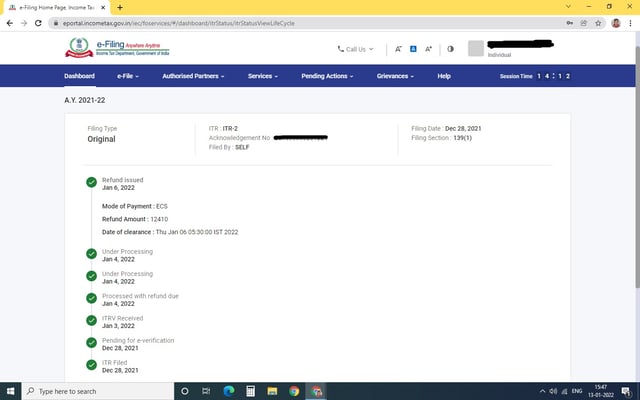

- Procedure Income tax e filing website

- Income tax login register / registration

- Income tax submission status

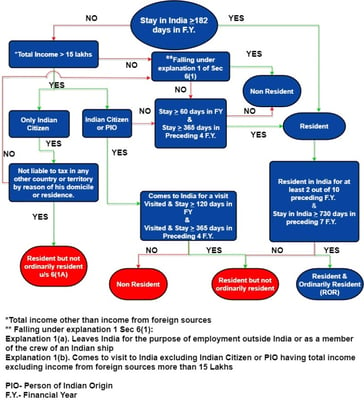

- Do NRI have to file income tax return? Is ITR mandatory for NRI?

- NRI tax on rental income? NRI selling property tax? F&O trading tax?

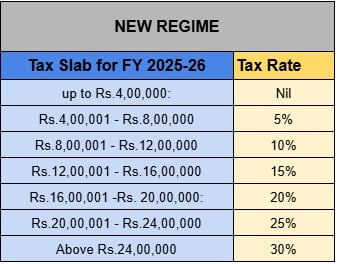

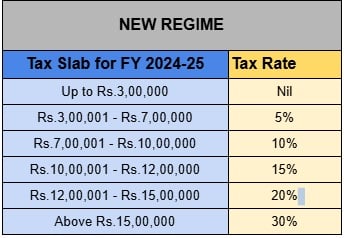

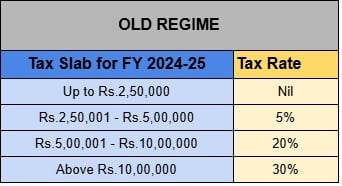

- Capital gains tax for NRI? Tax slab for NRI?

- How to claim TDS refund? How to file NRI tax return?

- Should NRI file Tax returns in India? Does NRI need to file Tax return?

- Wills, Transmissions, Legal name change

Convert NRO to NRE - Repatriation

NRIs are permitted by RBI to transfer funds from their NRO account upto US $ 1 million per financial year, for credit to their NRE account. Refer RBI Circular No. 117 dated May 7, 2012 and notification No.FEMA 5 /2000-RB. We handle this process for you.

Documents required:

- Pan card copy & Passport copy of giver & receiver

- Signed NRO Cheque of giver for specified amount in favour of receiver, upto $ 1million

- Receivers NRE cheque leaf copy or Bank name, a/c title, a/c number, branch, IBAN, IFSC, MICR

- Fema Declaration (we will provide)

- Self Declaration (we will provide)

- CA Certificate Form 15CA , 15CB (we will provide)

- Pay service fee, Time: 14 days

Please courier the above documents (1, 2, 3), after which payment can be made and transaction can be processed.

Convert Resident a/c Rupee funds to NRE, AED, $

Sender and receiver must be first degree relations i.e. parent/children, spouses. Upto US $ 200,000 per financial year. Refer RBI Circular No. 117 dated May 7, 2012 and notification No.FEMA 5 /2000-RB

Documents required:

- PP & Pan card copies of both account holders, including joint a/c holders

- Recipient account details (A/c title holder(s), bank name, Bank branch/city, swift, IBAN)

- Resident cheque for amount to be repatriated, upto 200,000$

- Signed application (we will provide)

- Declaration of intent letter (we will provide)

- Pay service fee, Time: 14 days

- Please courier the above documents (1, 2, 3), after which payment can be made and transaction can be processed.

Do NRIs need to file returns and pay taxes?

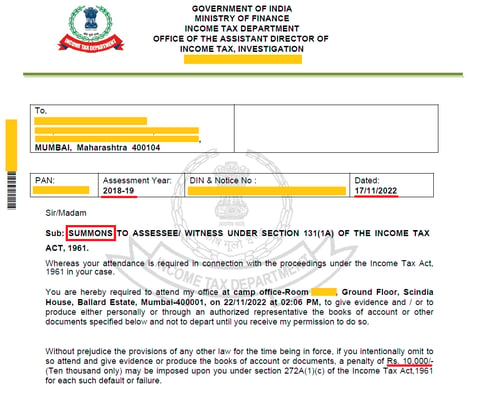

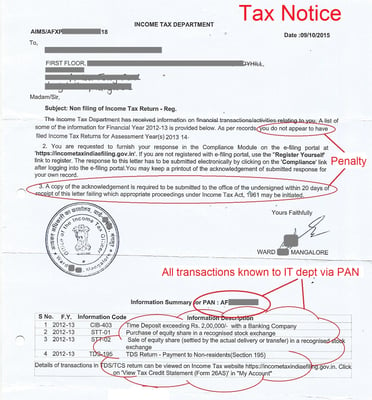

Yes. Why? See notice alongside, received by NRI client without Indian income. Notice received in July 2018 for 5 year old transactions. Can you get necessary info after 5 yrs? Even from banks / brokers which have closed? To avoid this trap we recommend NRI's file tax returns every year, even if they do not have income in India

- Notices can be sent up to 3 years back (Section 148)

- Many NRI's are unaware of Tax Notices due to change in address. Is your email during PAN application still valid?

- NRI's usually get TDS refunds

Products and Services

Tax

- Handling of Summons from IT department

- Handling of Notice for NRI

TDS

- NRI TDS payment on property sale

- NRI TDS payment on property rental

- TDS compliances

- Reduced TDS certificate for property sale

- NRI TDS Payments

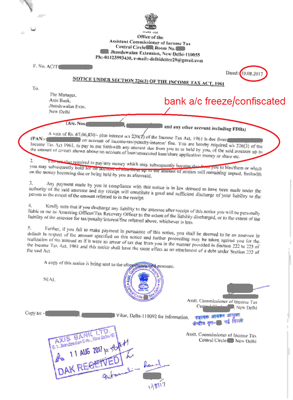

Types of Tax Notices

- Section 143(1) Customary notice

- Section 156 Demand Notice. Deposit outstanding dues within 30 days

- Section 142(1) and 143(2) Inspection notices. Tax department requires verification or reassessment. Respond within the stipulated time

- Section 148 - Show cause notice. Tax department is of the view that the tax payer concealed part of income to escape tax. Furnish the return within stipulated time

- Section 245 - Refund adjusted against the tax demand. Respond within 30 days else adjustment is done automatically if the assesse fails to respond.

Penalties

| Section | Nature of Default | Quantum of penalty |

| NON PAYMENT | ||

| 221(1) | Tax payments including Self Assessment Tax | Amount of tax in arrears |

| Failure to comply | ||

| 271(1)(b) | with the notice u/S 115WD(2)/ 115WE(2)/ 143(1)/ 142(2) | Rs. 10,000 of each failure |

| 271(1)(b) | with direction u/s 142(2A) to get audited | Rs. 10,000 of each failure |

| 272A (1) | Failure to answer questions or sign statements | Rs. 10,000 of each failure |

| Concealment | ||

| 271(1)(c) | Concealment of income or inaccurate particulars | 100 % to 300 % of tax sought to be evaded |

| 271AAA | Undisclosed income found during search intimation u/s 132 | 10% of undisclosed income |

FAQ

- Need help replying to Income Tax Notice?

- Need help filing Income Tax Return ITV-5?

- How to check my address in Tax system?

- Need CA auditor consultant to file ITR?

- Pay tax on my flats / properties?

- Need assistance with ITR tax filing?

- Need help getting Income Tax refund?

- Have I got a Tax Notice?

- How to check for old Notices?

- What is last date to file returns?

- ITR bharna hai?

- Need advisor to reduce tax?

- Tips for saving reducing tax

Client Reviews now showing directly on Google, See Google reviews

Deca

Deca

Mr. C.B.A. 49,Al Taawun, Sharjah (Monday, 02 September 2024 23:23)

Thank you very much for the effort to complete the first ITR filing process for me.

I have received the balance money in my account.

Thanks for the hassle free experience with the DECA team.

Mr. S.V. 48, Westo Centre, Sharjah (Friday, 30 August 2024 05:37)

I sincerely express my gratitude towards your timely and prompt e-filing of my ITR and e-verification.

My sincere and humble Prayers to the Almighty to Bless you and your Team Deca for future Prospects and endeavours.

Mr. M.S.R., Oud metha , Dubai (Monday, 08 January 2024 00:50)

Thank you team Deca for completing the work quickly and efficiently filing ITR before the deadline. I really appreciate all the efforts put in by team Deca to put together ITR, in a tight time limit.

I look forward to your help again with the next filing in April 2024. Wishing you all a Healthy and Happy New Year 2024.

Mr. S.V. 47, Westo Centre, Sharjah (Monday, 14 August 2023 04:23)

Thanks for your kind and effective assistance throughout the process. I shall get in touch with you, upon new investments and until then, my sincere and humble Prayers to the Almighty to Bless you and your Team for future Prospects and endeavors. It was a wonderful experience with Decca and In Sha Allah, I shall look forward to e-file my Returns for the upcoming year, as well with Decca, if time permits. All the very Best for you and your Team, again.

Mr. D. B. 66, Koikondahalli, Bangaluru (Thursday, 10 August 2023 00:16)

Thanks to you and the Deca team for the good work.

Appreciate all the hard work including working on public holiday.

Ms. M.B.P., 62, Nariman Point, Mumbai. (Monday, 13 March 2023 02:30)

Finaly, I got my Last year refund. Thanks Deca for your effort in resolving my bank issues.

Ms. M.L., 52, Alappuzha, Kerala, (Monday, 13 March 2023 02:07)

After receiving intimation that a refund was due, it took so long for the funds to actually be credited. I appreciate your continuous efforts in getting my refund credited.

Ms . S.S.S., 48, Al Fattan Currency House, Dubai, UAE (Tuesday, 07 March 2023 00:09)

I don't understand why every year my bank gives a problem at the time of refund. I appreciate your assistance in resolving those issues & now I got my refund. Thank you DECA

Mr. P. K. M., 46, Taman Leader Garden, Malaysia (Tuesday, 10 January 2023 02:03)

As I missed the due date for filing my returns, I was tensed about the same. But thank you all for the immediate response and efficient work. Refunds are credited to my account. Thanks a lot for your excellent service and assistance. Appreciated!

Ms. M. H. M., 66, Buckinghamshire, England. (Tuesday, 10 January 2023 02:02)

Return was filed just a month ago and now the refund is credited to my account. You all kept me updated in all stages. Once again I would like to mention that it was a wonderful experience seeing this job completed efficiently. Thank you very much dears, God bless.

Mr. A. M,52, Ashokanagara, Mangaluru, Karnataka (Tuesday, 03 January 2023 00:30)

Thank you very much for filing my ITR at my request on the final day being the weekend,just before the deadline.It has been processed successfully.Thanks for quick support

Ms. L. M., 31, Kodambakkam, Chennai, Tamilnadu (Tuesday, 27 December 2022 05:50)

This is my second time filing returns through your team. The process of filing was smooth and flawless. The refund is now credited to my account. Thank you so much for your assistance.

Ms. J. C. D., 57, Kuwait (Monday, 26 December 2022 06:02)

Without any difficulty, you people helped me & my daughter a lot in getting my refund credited to my bank account. Thanks & stay blessed.

Mr. I. D. M.., 55, Shalom , Kappettu, Udupi (Wednesday, 21 December 2022 06:09)

You have been filing my taxes for nine years now, got the refund for FY 2021-22 too. Many thanks, hoping to continue in the future years the same way, give me the same kind of service

Mr. B. A. R., 43, Al Qarah Industrial Area, Sharjah, UAE (Tuesday, 20 December 2022 05:26)

I finally got my ITR refund after numerous bank validation failures. Appreciate DECA IT team for helping me to solve all these issues.

Mr. M. C., 57, Karama, Dubai, UAE (Wednesday, 14 December 2022 05:38)

Thank you so much Team Deca, I got my refund credited to my account. You kept me updated from the date of receiving the documents till the date of refund. Appreciate your service. Please complete my wife's job also & keep me updated.

Ms. S. L. P., 42, Jebel Ali, Dubai, UAE (Monday, 12 December 2022 04:28)

On the final day (deadline), you filed my ITR per my request, appreciate your super service. Happy to do trading with you all, get the other services also promptly. There was an issue with my bank, the refund failed on the first attempt. Amazingly, you resolved it & I received the refund.

Mr. P. K.., 57, Abu Dhabi, UAE (Friday, 09 December 2022 04:29)

Thank you Deca, unlike last year, this time I received my refund on the right bank account, very fast also. Please pardon me if I was unkind at any point, but I sincerely appreciate your support.

Mr. B. M.., 52, Doha, Qatar (Friday, 09 December 2022 04:28)

I got my refund. Thank you for the successful completion of the job, and request you to remind me next year too.

Mr. S. S., 26, Karama, Dubai (Wednesday, 07 December 2022 01:58)

I have received my refund. Thank you for the reminder to file and finish the task successfully, expecting the same level of service always.

Mr. V. R.., 54, Wadi Al Safa , Sharjah, UAE (Monday, 05 December 2022 03:45)

This is the ninth year that you have filed mine & my wife's ITR. Thank you team for all of your help throughout these years. As usual, my wife and I received our refund without any issues.

Mr. V. V..., 45, Kochi, Kerala (Monday, 05 December 2022 03:44)

Thanks deca I got my first ITR refund, all thanks to your team for the zoom meeting with complete explanation.

Mr. A N., 44, Hamdan street , Abudhabi, UAE (Friday, 02 December 2022 06:05)

Thank you DECA, for filing mine & my wife's ITR, resolving issues that arose during property sale. we both received refund

Ms. B. C., 49, Bolar, Mangaluru, Karnataka (Friday, 02 December 2022 06:05)

Thank you Deca, for helping me successfully file my first ITR. I received a refund.

Ms. V. R..,81, Kulshekara, Mangaluru, Karnataka (Wednesday, 30 November 2022 06:12)

I am a super senior citizen. I sincerely appreciate your help with my ITR file. I got my refund. God Bless you all..

Ms. N. K. I.., 65, Blackheath, London, U.K. (Monday, 28 November 2022 00:10)

Thank you Deca, I have received my IT refund for this year. I appreciate it, but how to go about the refund from the previous year? Kindly assist.

Mr. G. N., Al Barsha, Dubai (Monday, 28 November 2022 00:08)

I got my refund. Thank you Deca. Also expecting a reminder next year also, please.

Mr. V. F. , Sharjah, UAE (Friday, 25 November 2022 03:38)

I appreciate your efforts in resolving my bank issues, everytime the bank verification was failing. I finally received my refund, thank you friends.

Ms. J. R. P. 66, Al Muraqabat, Deira, Dubai, UAE (Tuesday, 22 November 2022 05:03)

Huge sum of TDS is deducted year on year. However, thanks to you dears, I don't have to worry about it because you people are filing my ITR regularly without fail. I received everything back in my bank account with interest (notification forwarded to you). Thanks a lot, it is a big help as my husband used to look after everything till his demise. I was worried how to handle all these, really a big big thanks.

Ms. M. S. S., 49, Gandhinagar, Mangaluru, Karnataka (Tuesday, 22 November 2022 05:02)

I have received my refund. Thanks Deca for the successful completion of the job as usual.

Ms. S. M. D., 41, Dubai, UAE (Tuesday, 22 November 2022 05:01)

Perfect completion of a job, I received my refund as usual without any issues & this time even before my husband received his refund. Sincere appreciation.

Mr. P. L., 62, Vittalwadi, Pune, Maharashtra (Friday, 18 November 2022 05:19)

I received my first refund, thank you Deca for the zoom meeting arranged in regard to my TDS, etc.

Ms. B. C., 49, Bolar, Mangaluru, Karnataka. (Thursday, 10 November 2022 06:32)

Thank you Deca, for helping me successfully file my first ITR. I received a refund.

Ms. V. R..,81, Kulshekara, Mangaluru, Karnataka (Thursday, 10 November 2022 06:31)

I am a super senior citizen. I sincerely appreciate your help with my ITR file. I got my refund. God Bless you all..

Ms. S. C., 40, Dubai, UAE (Monday, 07 November 2022 07:02)

Refund is credited to my account. I think this is the quickest refund I have received. Thank you so much to the whole team :)

Mr. A.S., 48, Kadri,Mangaluru (Monday, 07 November 2022 04:47)

Dear Team, Refund received, Many thanks for the due diligence done to maximize tax deductions such as Health Insurance, Loss booking in Futures and options trading a/c etc

Mrs. J. D., 30, Yelathoor, Kinnigoli. (Friday, 04 November 2022 01:14)

Finally received my husband's refund. Never expected this refund to be credited after a year, appreciate your assistance in resolving the bank-related concerns.

Ms. R. L. L., 61, Dubai, UAE (Wednesday, 02 November 2022 06:57)

Thanks to the DECA team, my ITR for this year was successfully filed, received my refund. My prior service provider caused me a lot of problems over the years, also my previous year filing is still unfinished. Request you to kindly take forward my pending issue, thank you.

Mr. M. S. S., 50, Mahim, Mumbai, Maharashtra (Tuesday, 01 November 2022 05:26)

I'm filing my ITR for the first time, and was very confused and curious. Thank you for answering all of my questions, satisfying my curiosity and filing my ITR. I received my first refund, thanks.

Dr. S. J. I., 30, Meera Road, Thane, Maharashtra (Tuesday, 01 November 2022 05:25)

Thank you Deca for all your help with my first time ITR filing. I got the refund too

Dr. A. R. K., 31, Viman Nagar, Pune, Maharashtra (Friday, 28 October 2022 07:08)

Cheers, so happy that I got my refund much earlier compared to the past so many years.

Mr. M. S. 29, Burj Khalif, Dubai, UAE (Friday, 28 October 2022 07:07)

Similar to last year, timely and speedy job execution. Thank you Deca.

Mr. H. V. D.. 39, JLT, Dubai, UAE (Thursday, 27 October 2022 05:53)

Thank you for the continuous follow up & efficient completion of this job,

Ms. S. B.. 77, Charkop, Kandivali, Mumbai (Thursday, 27 October 2022 05:52)

Thanks for filing my ITR & providing me with the best service at a moderate rate.

Mr. H. A. P. 47, New Al Taawun Road, Sharjah, UAE (Friday, 21 October 2022 07:10)

Thanks for your best co-operation. I got my refund.

Ms. L. M. B. 77, Kandivali W. Mumbai, Maharashtra (Thursday, 20 October 2022 07:03)

Being a senior citizen, I found it extremely challenging to gather the information I needed from many sources in order to file my ITR. Thank you Deca, your team accomplished it without my assistance. And I just got my refund.

Mr. Y. S. 29, Silicon Oasis, Dubai (Wednesday, 19 October 2022 07:16)

:I was provided with excellent service, thank you.

Ms. D. D., 34, Dubai, UAE (Tuesday, 18 October 2022 06:06)

Thank you so much. Refund is credited to my account. Once again it was a wonderful experience filing my return through your Team. Work was carried out very efficiently.

Ms. M. D., 59, Bangalore, India (Tuesday, 18 October 2022 06:05)

Refund is credited to my account. Thank you very much. You all kept me updated in all stages of the filing process. Appreciated.

Mr. T. C. D. B., 65, Bangalore, India (Friday, 14 October 2022 06:03)

Thank you so much Team Deca, I got my refund credited to my account. As usual the process of filing ITR with your team was flawless. Very happy and satisfied with your work.