How to obtain a Succession or Legal heir certificate, Probate

+91 - 9741810055

Call/SMS

decassip@gmail.com

India - Letters of Administration

Joint accounts - A good idea?

Step 1: Determine Jurisdiction of court where appeal is to be filed. Jurisdiction will depend on where the deceased had residence. or, if at that time he/she had no fixed place of residence, the court within whose jurisdiction any part of the property of the deceased may be found.

Step 2: Detailed preparation of documents and court appeal. All documents will have to be verified and certified by competent authorities. Often documents will need to be translated to language admissible in courts. International documents will need to be apostilled, notarised and attested at embassy consulate.

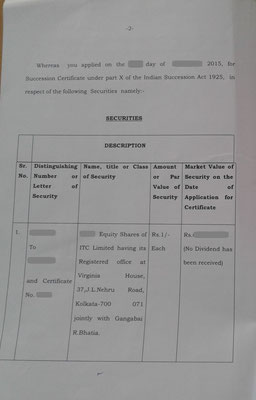

Step 3: Application and follow up of appeal for Succession certificate or Probate. This could take 2-3 months or even upto 1 year, depending on the court and country. Usually this involves several visits to court, answering of court queries and submission of additional proofs when called for. Once the Succession certificate of Probate is obtained the assets can then be unfrozen and distributed to the heirs in the proportion determined by the court.

It is customary for people to have bank accounts in joint names or hold property in joint names. However when either 'Joint' holder dies the account or property is frozen. The registrar (land department) or custodian (bank) will insist that the surviving holder produce a Succession Certificate (Probate) and Court instruction before unfreezing the asset. In the absence of a Will (by the deceased holder) the procedure could take much longer and result could be complicated. Therefore a Will is a must. Once a Will is in place there is no need for a Joint account holder.

Nominee - A good idea?

Most people think that specifying a nominee is the only step required to ensure smooth transmission of their assets upon their death, However, most do not understand that a Nominee is NOT automatically the Legal Heir. Therefore a Will is a must. Once a Will is in place there is no need for a Nominee.

Types of bank accounts . . .

There are several types of accounts. It is important to understand how each works and the associated risks before you choose the right one for you.

- Single holder account: You hold an account as sole beneficiary. In the event of your death the proceeds will be paid to your nominee (who may not be your legal heir)

- Either or Survivor account You hold this account with another person. Either of you will have the right to operate the account. Should one of you die the other will have the right to continue operating or withdraw all the money and close the account

- Joint account You hold this account jointly with another person. Either of you may be able to deposit money into this account but to withdraw both of you must sign jointly. Should one of you die the other will not be able to continue operating and will not be able to liquidate and close the account. The surviving account holder will need to procure a Succession certificate for the deceased. In the absence of a Will it will be expensive and time consuming to obtain a succession certificate. However once a succession certificate is obtained the Legal heirs are registered as account holders in place of the deceased after which the account can be liquidated and proceeds paid out in the correct proportion

Deca NRI Services

Deca NRI Services